Before moving in with someone, not to mention agreeing to spend the rest of your life with them, it’s crucial to have a money talk. It might not be romantic, you might not feel comfortable, but it is an important step to take for the well-being of both people involved, as well as their relationship.

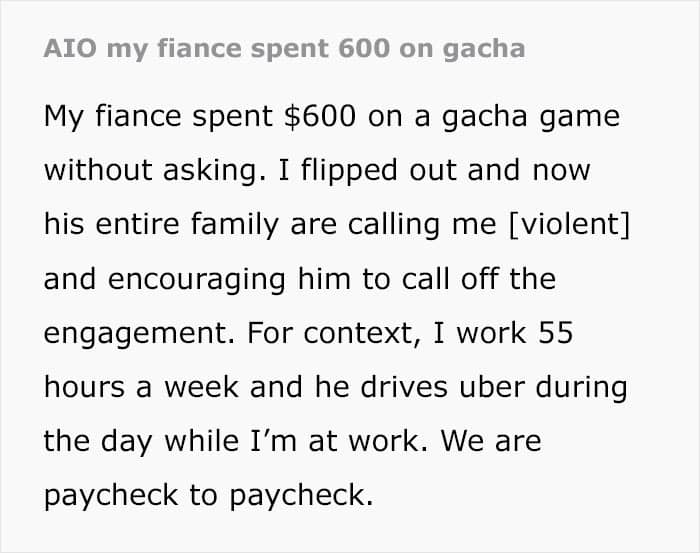

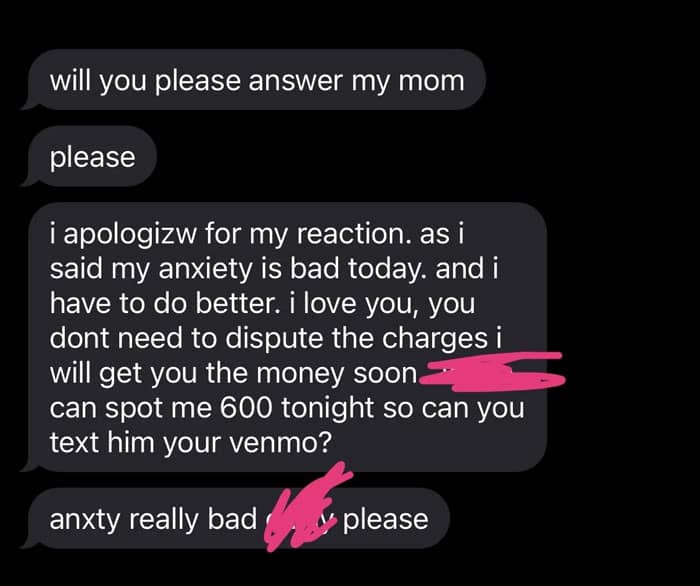

One redditor recently shared how a money-related incident caused a great deal of stress and strained the relationship with her partner. Despite the couple living paycheck to paycheck, the OP’s fiancé spent $600 on a game, throwing the woman off the deep end. To make matters worse, his family didn’t take long to side with him. Scroll down to find the full story below.

RELATED:

Spending money on computer games should not be a priority when living paycheck to paycheck

Image credits: ELLA DON / Unsplash (not the actual photo)

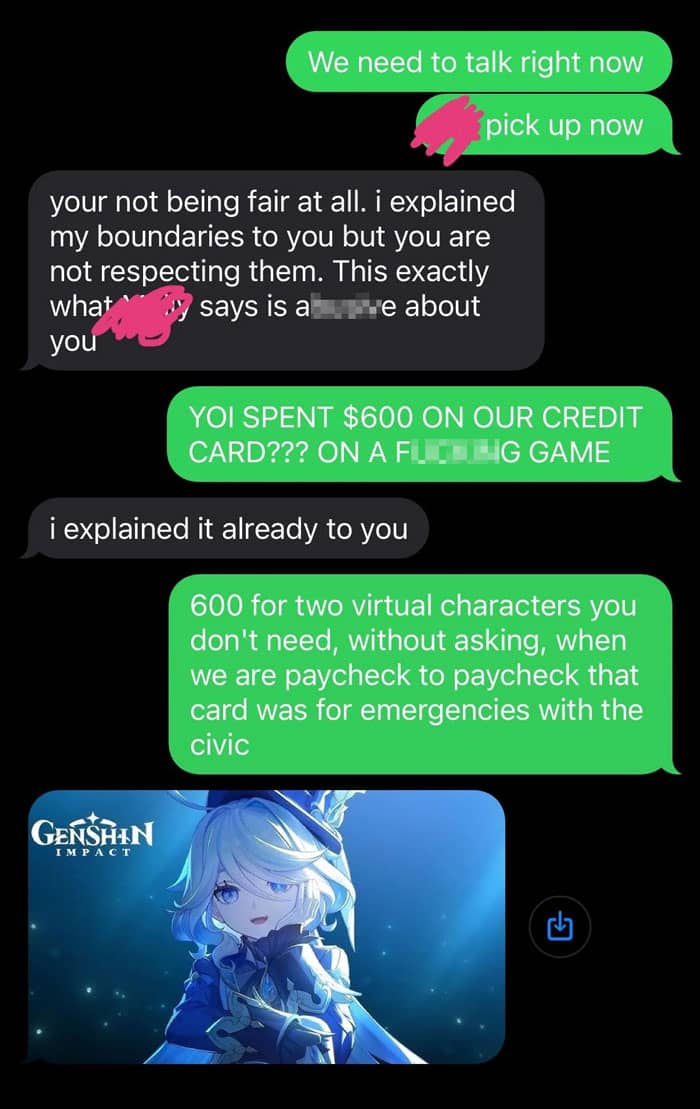

This man spent $600 on a game, seriously infuriating his partner

Image credits: Creative-Guard2809

When talking about money with your partner, it’s best to start with easier questions before moving to the difficult ones

Money might not be the most romantic topic there is, but it’s an important one to discuss before starting your life with someone. That is because so many things in life involve making financial decisions. If you move in together, for instance, how do you pay the rent? Who buys the groceries? Are you expected to pay your partner back for half of said groceries?

These questions can only be answered by having an honest and open talk about money with your partner; which, ideally, should be done on a regular basis. Though some experts believe that such conversations don’t necessarily have to be a big deal; they can even happen rather organically, if we let them.

“I find that money comes up pretty naturally if we let it, that it gets harder the more we think of it as a very special talk about money,” financial therapist Amanda Clayman shared, talking on NPR’s ‘Life Kit.’ “I think the more we just invite these more mundane conversations about money into our lives, the more we just find that communication flows.”

According to the expert, when it comes to figuring out finances in a romantic relationship, it’s best to start off slow, with questions like “how comfortable do you feel being open about money?” Over time, the couple can move on to heavier questions, regarding their earnings, loan or debt, and practices for handling money.

Talking money may lead to conflict, but many people are on the same page with their partner regarding finance, nevertheless

Even though talking about money can have a positive impact on people’s relationships, many find it hard to do, especially if they’re already stressed about their finances. One study found that people who experience high financial stress are less likely to communicate with their partner about money, as they fear it will lead to conflict.

Such fear isn’t irrational. An Ipsos poll from 2024 found that roughly one-in-three partnered Americans see money as a source of conflict in their relationship. But despite the conflict, the vast majority of respondents—as much as 84% of them—say that they are on the same page with their partner when it comes to finances. Nearly nine-in-ten say they are comfortable discussing the topic with their partner, too, emphasizing the importance of open communication.

According to Clayman, being open with your partner about money makes finance a form of romance, in a way. “That vulnerability is a really important part of intimacy,” she told NPR. “The messiness, the part that we’re still figuring out, like when we can share that with another person? That’s really where that magic connection happens.”

Romance can be lost, though, when people aren’t honest talking about money with their partner. The Ipsos poll found that more than a third of respondents were untruthful about money with their spouse. A similar number of respondents believed that their significant other spends too much on impulse purchases, which is unlikely to make the romance bloom, either.

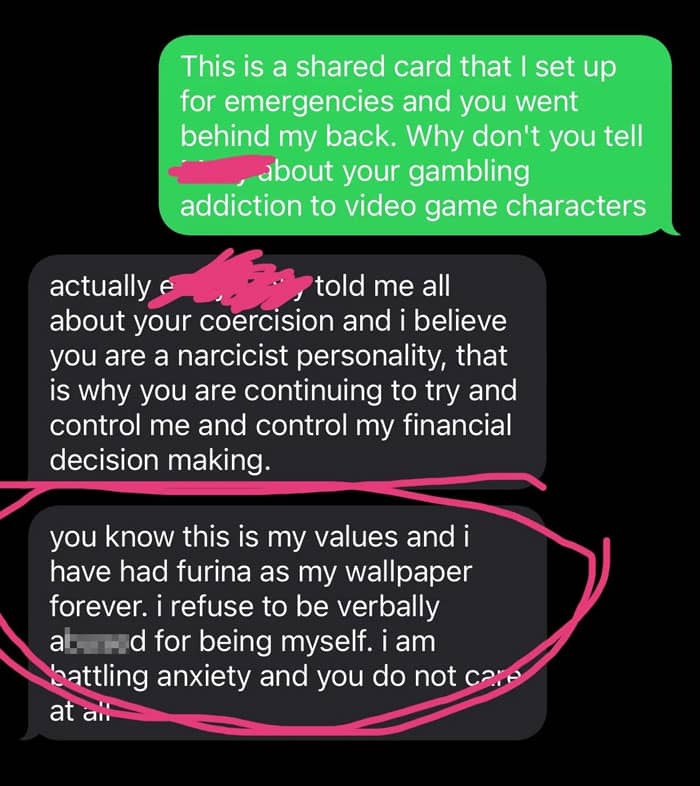

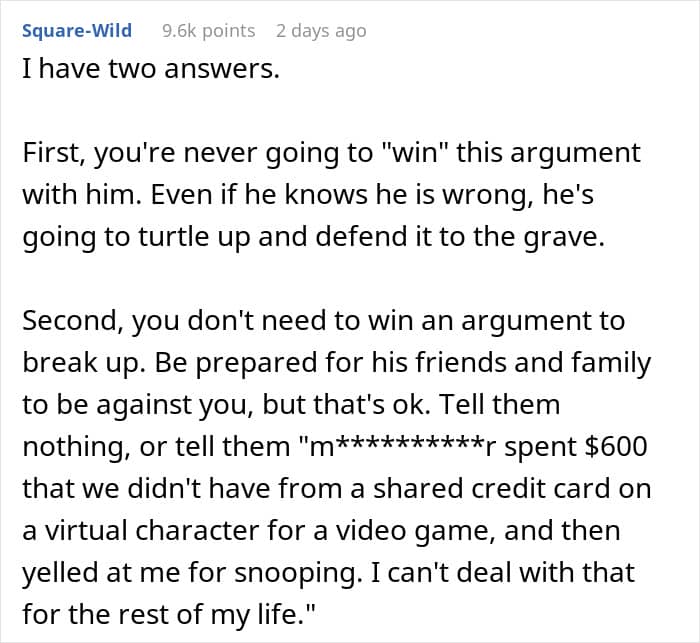

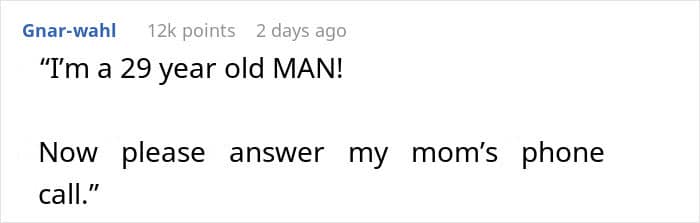

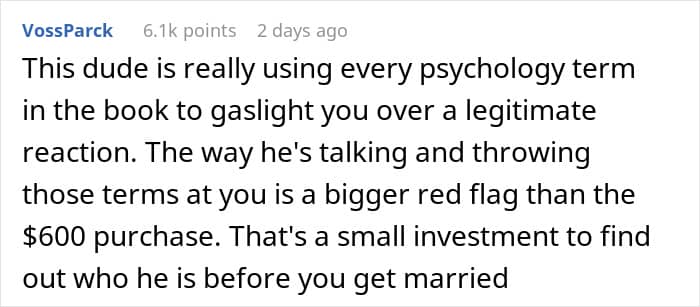

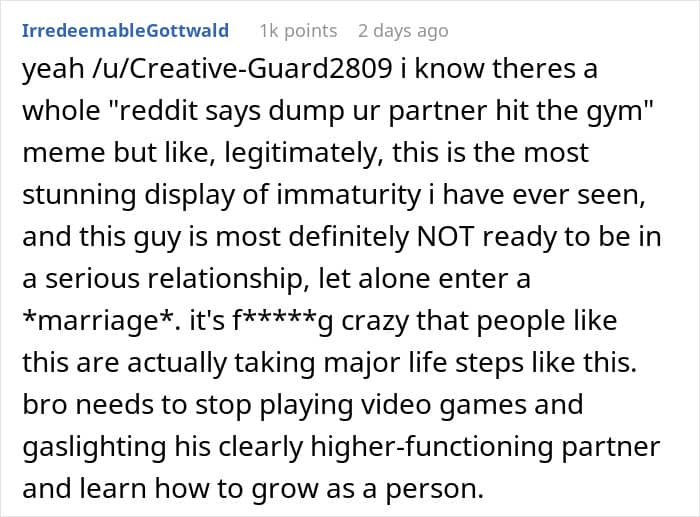

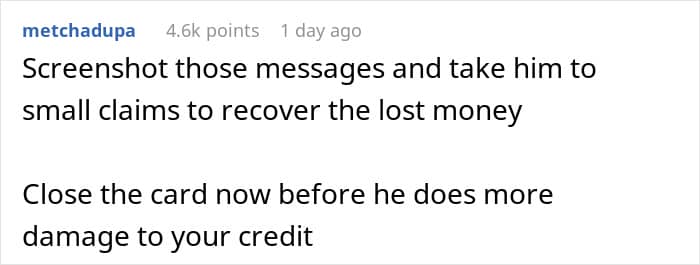

For the OP, her fiancé spending $600 on a game resulted in not only romance fading away, but the relationship ending altogether. She couldn’t believe her partner spent so much money using their credit card, when they were living paycheck to paycheck. To make matters worse, the credit card wasn’t even “theirs”; it was actually hers, which made the fiancé’s purchase without so much as discussing it first even more bothersome.

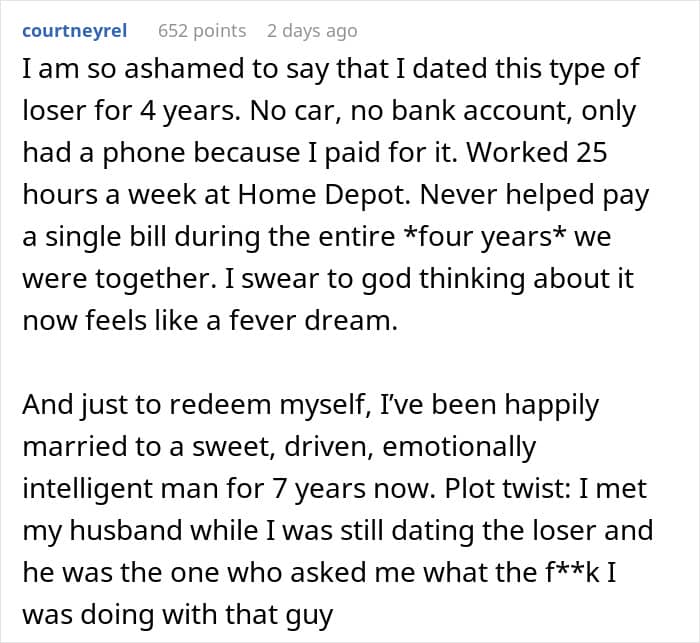

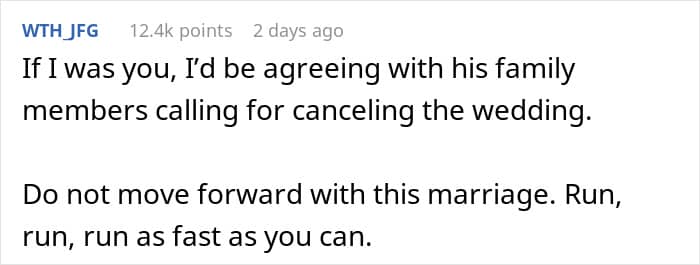

Fellow netizens shared their thoughts on the situation

The woman provided an update, letting the community know how the story developed

Image credits: Getty Images / Unsplash (not the actual photo)

Image credits: Creative-Guard2809