Money makes the world go round. Even though there are lots more important things in life than cash—like your positive relationships, health, fun hobbies, adventures abroad, and endless cat memes—it would be disingenuous to say that your income doesn’t matter. It does because it offers you the opportunities and flexibility to live a high-quality life the way you want to.

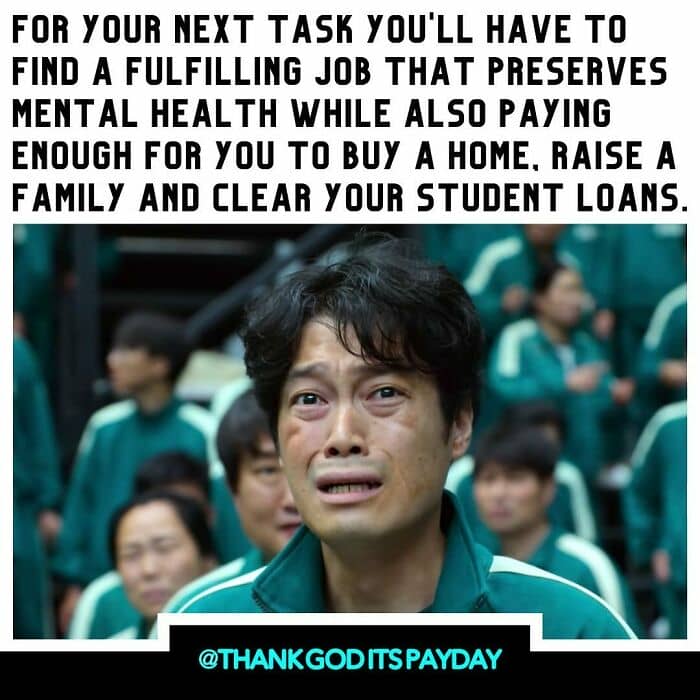

However, things get a lot easier if you can joke about your (lack of) wealth. That’s where the ‘Thank God It’s Payday’ Instagram account comes in. It shares incredibly witty and super relatable memes about work, money, (not owning any) property, and living paycheck to paycheck. Scroll down to enjoy some of the best posts, whether you’re on your coffee break or waiting for your next paycheck to hit your bank account.

#1

#2

#3

There’s a lot of economic uncertainty on a global scale after the US administration threatened tariffs on pretty much every nation on Earth.

CNN warns that these tariffs could lead to stagflation, “a toxic combination of stagnant growth and rising inflation that plagued the Fed [the Federal Reserve] in the 1970s and early 1980s.” That being said, Fed Chair Jerome Powell recently said that despite concerns about stagflation, the American economy is on solid footing.

#4

#5

#6

Meanwhile, the US job market appears to be doing well, with employers adding 177,000 jobs (more than expected) and the unemployment rate holding steady at 4.2% in April 2025.

However, the trade war sparked by the administration has led to a contraction of US GDP at an annualized rate of 0.3% at the beginning of the year.

#7

#8

#9

Reporting on a recent analysis by the Yale Budget Lab, CNN states that the new tariffs could cost the average American household $2,000 in inflation-accounted disposable income a year.

For example, prices for computers could rise by over a tenth. Natural gas could spike by 5%. Rice could get 4% pricier. And the average price of a new car could reach over $50,000.

#10

#11

#12

It’s not just tariffs that are to blame, of course. Many products and services have already gotten far more expensive over the past half-decade due to higher inflation.

As per CNN, the cumulative inflation rate over the past 5 years has been over 23%. Compare that to the median 5-year inflation rate since the late 1940s, which stood at just over 14%.

In short, Americans are forced to empty their wallets more at the grocery store. And that’s not good news for the 25% to 30% of Americans who live paycheck to paycheck.

#13

#14

#15

Statista explains that wages and salaries are considered to be key economic indicators because they have a strong influence on a person’s quality of life

Back in 2000, the average annual wage in the United States stood at $57,499. It rose to $77,643 in 2022. That year, more than half of American households had an annual income of $75,000, but 11.5% were living below the US poverty threshold.

#16

#17

#18

Between 2021 and 2022, the inflation rate in the US surpassed the growth of wages, with monthly inflation peaking at 9.1% in June 2022. Due to the pressure from inflation, over a third of American consumers reported struggling to make ends meet at the end of 2022.

However, the situation improved later. Between March 2023 and March 2024, monthly wage growth consistently outpaced monthly inflation.

#19

#20

#21

Naturally, how much you earn at your job depends on a very wide range of factors, from the industry you work in and your position to your location and macroeconomic factors globally.

However, no matter the size of your paycheck, you should always strive to spend less money than you earn. That way, you can save and invest money every month, instead of dipping into your savings or going into debt.

#22

#23

#24

At the time of writing, the ‘Thank God It’s Payday’ account, created in February 2020, has just shy of 9k followers. The millennial curator of the page writes on Instagram that she is “just a boss babe trying to achieve financial freedom with the help of feel-good money memes.”

Meanwhile, she adds on Facebook that she is also big on sharing lifestyle hacks and money-saving advice.

#25

#26

#27

We’d love to hear your thoughts in the comments, dear Pandas! Which of the memes that we’ve featured here today made you laugh the hardest? Which pics did you relate to the most?

What are your biggest financial worries in this bizarre economic climate? And how do you maintain a healthy work-life balance?

#28

#29

#30

#31

#32

#33

#34

#35

#36

#37

#38

#39

#40

Note: this post originally had 65 images. It’s been shortened to the top 40 images based on user votes.