Christmas is meant to be a time of festive cheer… but for many, that’s not the case. Some people are lonely, others are grieving. Then there are those who find themselves in a financial position that makes it near-impossible to celebrate or be happy.

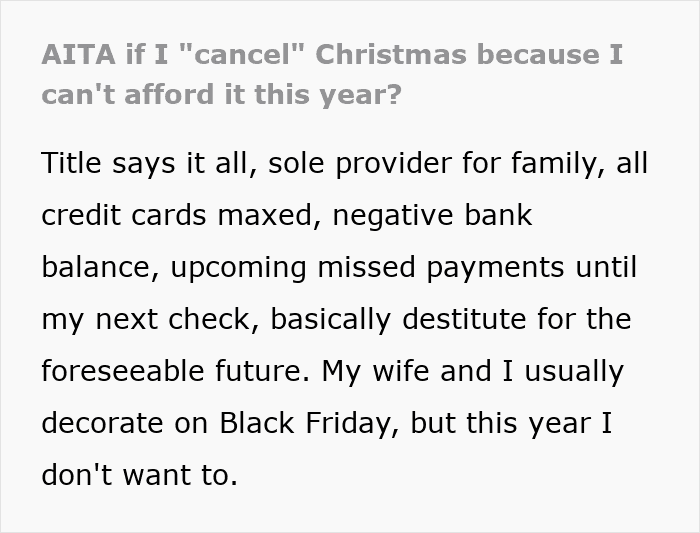

A man has left people in tears after revealing that he’s considering canceling Christmas because he’s officially broke and drowning in debt. He says he feels like a failure to his wife and little girl but doesn’t see the point of putting up a tree when there’ll be nothing underneath it. There’s been a collective outpouring of kindness and support, as people try to convince the father to rethink things for the sake of his family.

We reached out to WalletHub‘s financial writer and analyst, Chip Lupo to see what advice he has for anyone who finds themselves in a similar situation this year.

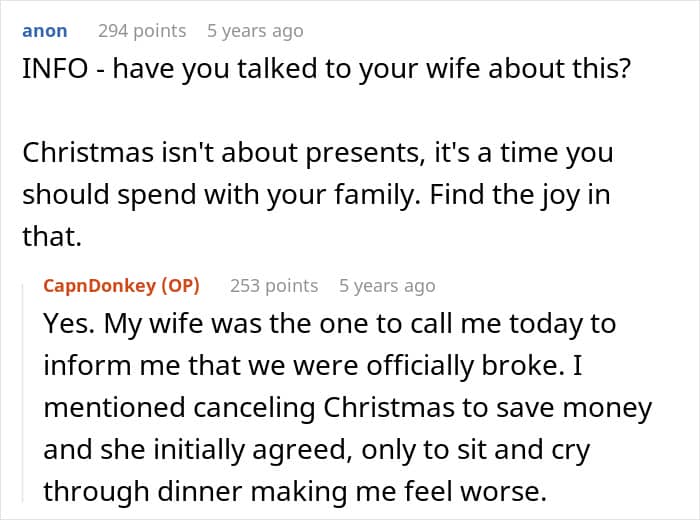

RELATED:How do you celebrate Christmas when you find yourself with a negative bank balance and have lost all hope?

This husband and father feels it’s better to pretend the holiday doesn’t exist, but many disagree

He later revealed how he’d found out he was officially broke

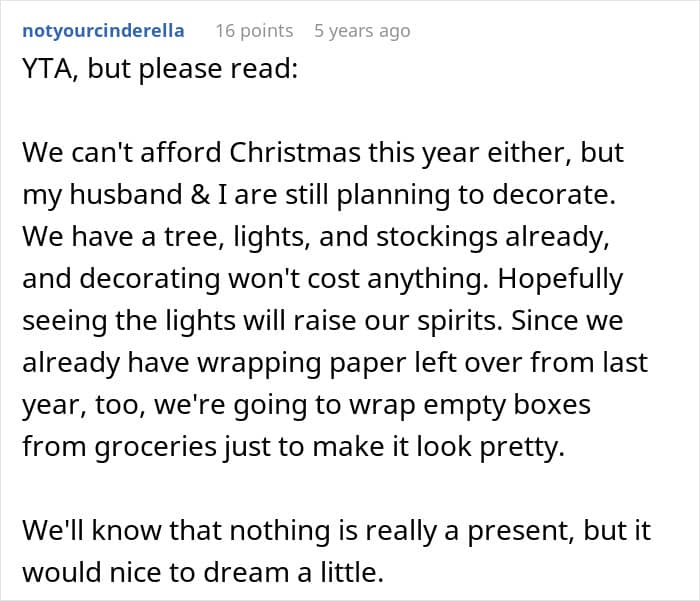

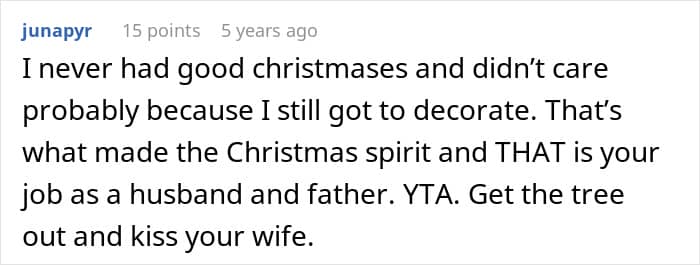

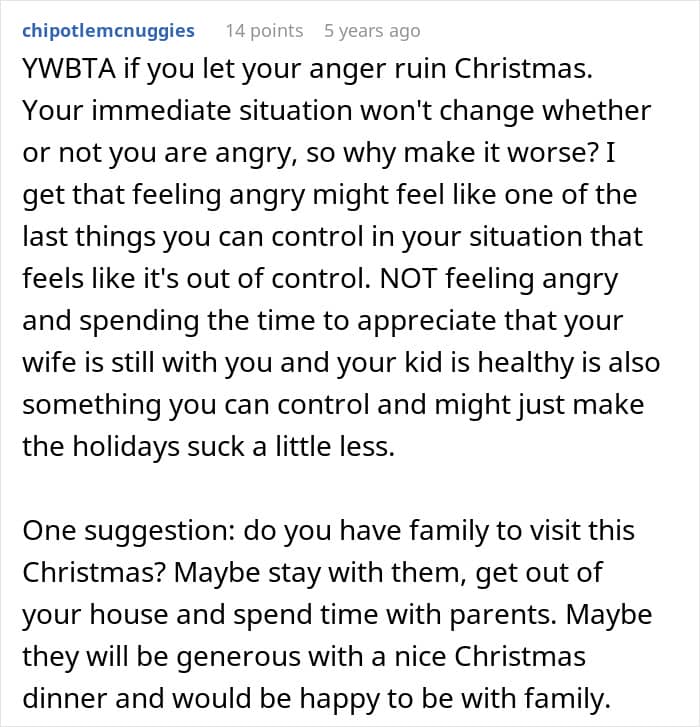

People assured the father that he’s not a failure and shared their advice

Dozens of strangers showered the man with support, while still reminding him that his family deserves to celebrate

Some suggested free ways to still have a merry Christmas

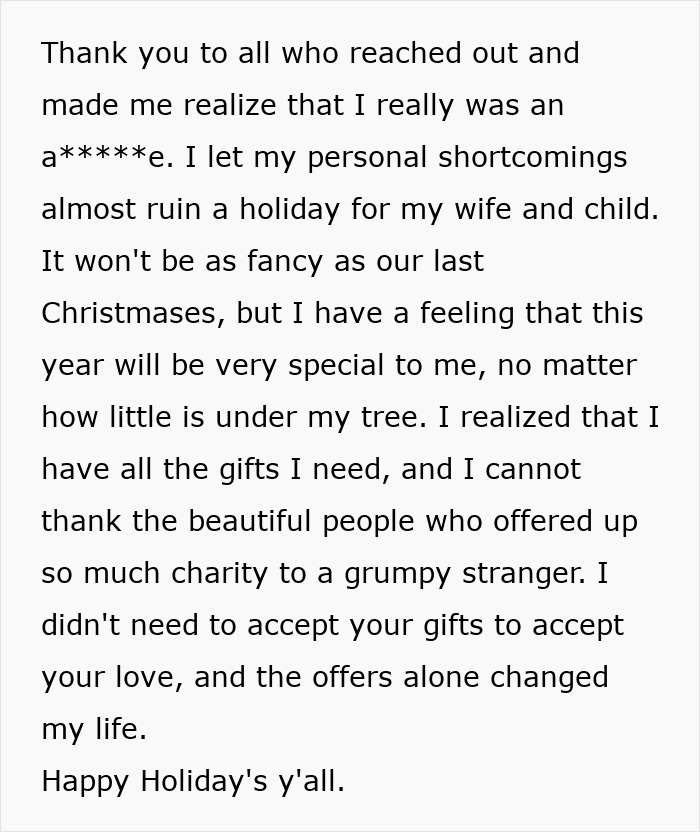

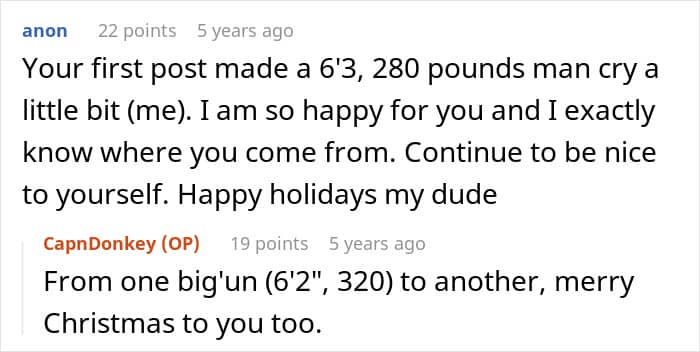

After an outpouring of offers and messages from strangers, the man said he’d taken time to rethink things

He also said that he’s sought professional help

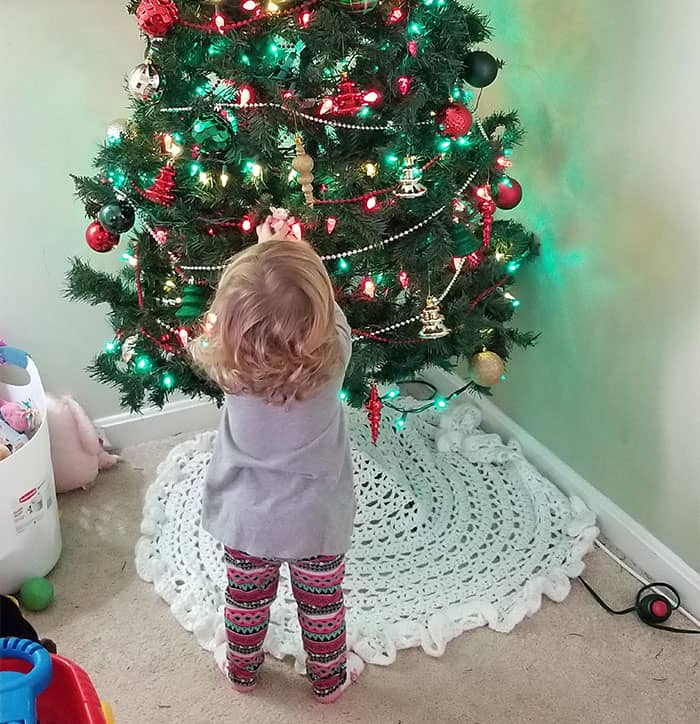

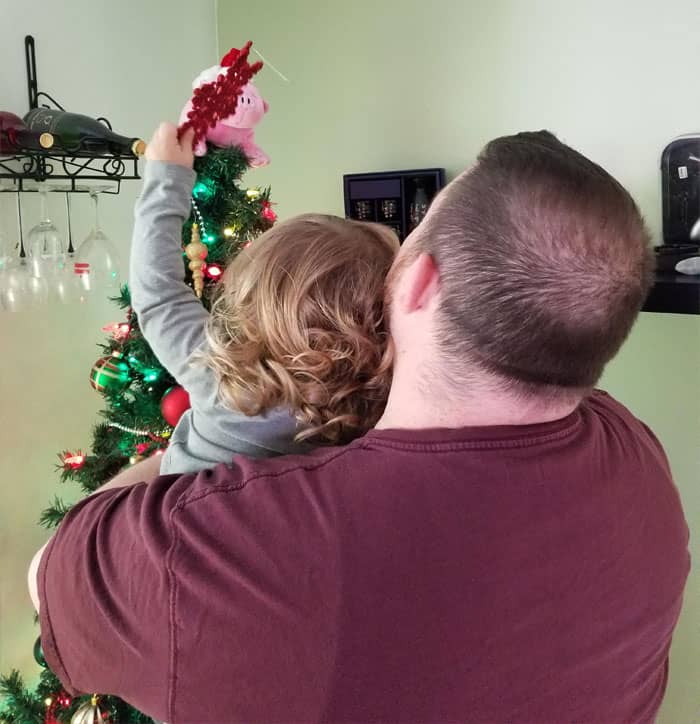

The dad gave another update 2 weeks later, and a lot had changed thanks to the collective kindness he received

“He’s not failing”: a financial analyst gives their 2 cents

“When someone feels this overwhelmed, the pressure of the holidays can make everything feel heavier,” says Chip Lupo, financial writer and analyst for WalletHub. “But the good news is that enjoying the season doesn’t require a lot any spending at all.”

We reached out to Lupo on behalf of the dad to see what advice he has when it comes to navigating the holiday season while drowning in debt. The expert told us that a WalletHub survey revealed that 81% of people feel better when they set a simple plan upfront.

“That doesn’t mean a long list or expensive gifts; just choosing one or two small items that feel doable,” he explains. “A budget or a low-cost plan can return a sense of control, which is often what feels missing when money is tight.”

Lupo adds that may also help to know that a huge share of people are simplifying the holidays this year. 42% of those polled say their budgets are “stretched thin,” and many families are shifting toward smaller traditions, handmade gifts, or skipping gifts entirely.

That means he’s not ‘falling short,’ he’s adapting,” says Lupo. “The same way millions of others are.”

The experts suggests that the man shouldn’t force cheer, or put up decorations, if it adds stress. “What matters most to a 2-year-old is the connection, not the size of a tree or the number of gifts,” he told us. “Even something small, such as a walk to look at lights, reading a holiday story, or making a simple craft, can become a meaningful moment without costing anything.”

“He’s not failing. He’s simply navigating a tough financial stretch,” Lupo said. “And there’s a lot of room to create a peaceful, low-pressure holiday that doesn’t add new debt or emotional strain.”

What to do if you find yourself deep in debt this Christmas, according to an expert

If things look bleak this year and you’re drowning in debt this festive season, Lupo says the most important step is to stop the bleeding and reset your plans.

“More than 1 in 4 Americans are still paying off debt from last holiday season, and 43% say they won’t pay their holiday purchases in full this year, so you’re not alone,” he adds. “Start by making a strict budget, which 81% of people say helps during the holidays. Avoid taking on new debt unless absolutely necessary, especially since 85% of Americans are already planning to spend the same amount of money, or less than last year.”

Lupo says you should also consider focusing on handmade or low-cost alternatives that can help you stay within your means. “If you must use credit, stick to tools that give you breathing room like 0% APR cards, rather than high-interest store financing. Most importantly, map out a realistic payoff plan so this year’s expenses don’t turn into next year’s stress,” he advises.

The expert believes there are plenty of meaningful ways to celebrate Christmas without spending a lot of money. According to WalletbHub’s survey,61% of Americans say they’d actually enjoy the holidays more without exchanging gifts. This shows that many people are open to simpler traditions.

“Free options like hosting a potluck meal, planning game or movie nights at home, and enjoying local holiday light displays can make the season feel special without adding financial stress,” Lupo suggests.

“Best update ever!”: people were thrilled and some even shed a tear

Christmas tree despite financial struggles.” />

Christmas tree despite financial struggles.” />