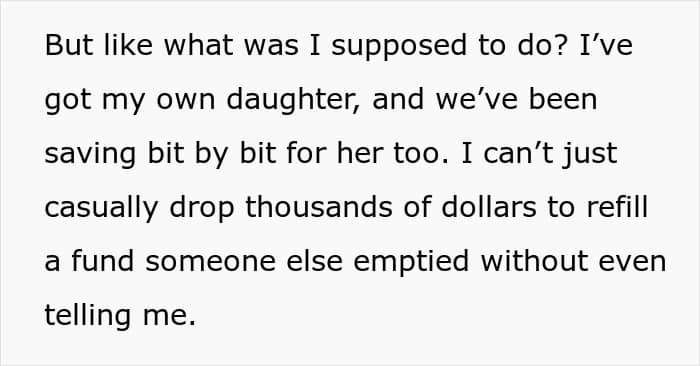

Family and money don’t always mix, and when they do, things can quickly spiral out of control.

In a post to r/AITA_WIBTA_PUBLIC, one woman shared a story about supporting her single-mom sister and contributing to her niece’s college savings over several years.

But after prom season rolled around and thousands suddenly disappeared from the account, a tense standoff began to unfold.

Suddenly, boundaries got blurry, and the generous act is now raising big questions about trust, priorities, and responsibility.

RELATED:Money disagreements can destroy families

Image credits: Kaboompics.com/Pexels (not the actual photo)

And this woman feels like she and her sister are already having problems

Image credits: Tony Meyers/Pexels (not the actual photo)

Image credits: Jörn Rockstroh/Pexels (not the actual photo)

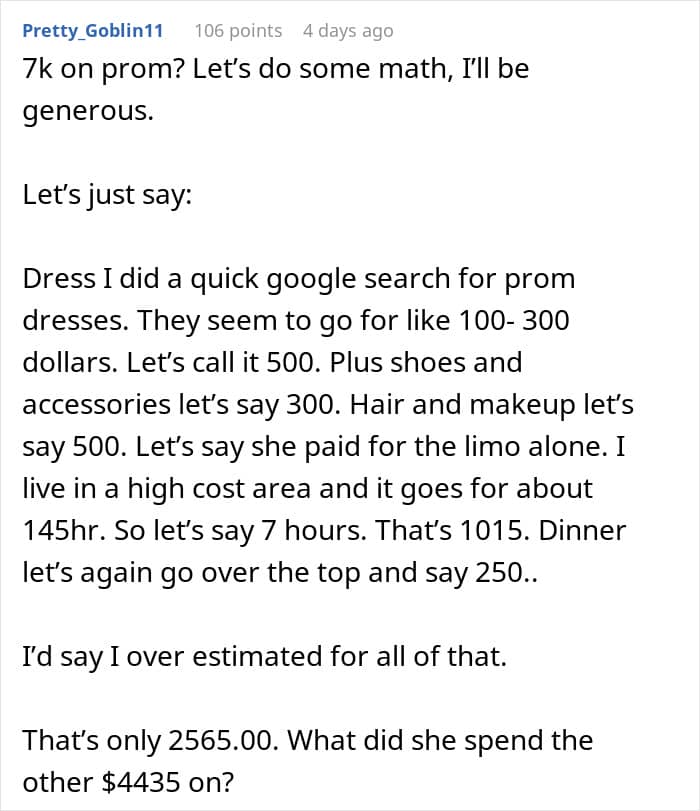

Image credits: promcollegefund

In this economy, a college fund can be life-changing

The fact that the woman is actively contributing to her niece’s future is definitely admirable. Higher education is getting more and more expensive in many places across the world, including the United States.

Here, the average tuition for out-of-state students at a public, four-year college or university for the 2024-2025 school year was $30,780. In 2023-2024, that figure was $29,840. This means tuition has increased 3.2% year over year.

Costs for dorms, meal plans, and transportation add up quickly. While institutions may handle these expenses differently, the average public, four-year college or university charged $13,310 for room and board.

Oftentimes, grants and scholarships don’t cover everything. The average projected loan balance over 4 years for undergraduates (subsidized and unsubsidized) was $26,360, while graduates (also, subsidized and unsubsidized) were expected to take out $78,080.

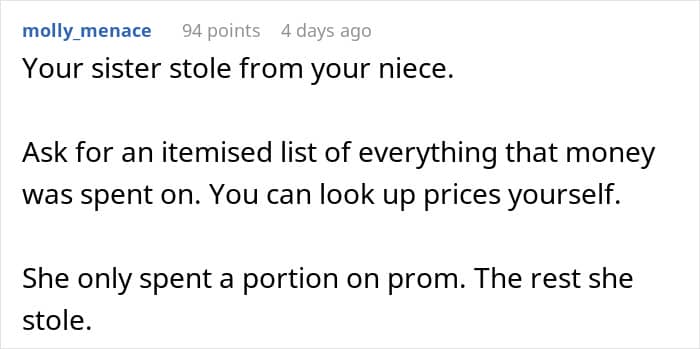

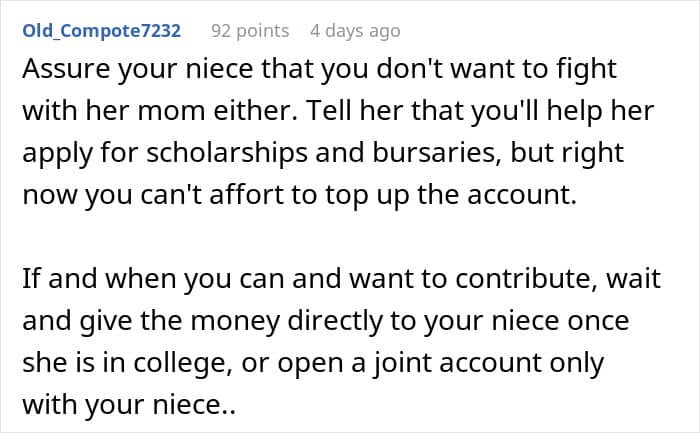

However, the legal aspects of this case might be murky

But it’s unclear how this conflict might end, should it escalate even more. Even its legal aspects might not be entirely clear.

For example, civil dispute experts at Miller Monroe Holton & Plyler say that, “A common misconception about ownership of joint account funds can lead people into trouble. Ownership of a joint bank account is shared between two people. However, even though they share ownership of the account, the account holders do not necessarily share ownership of the funds in the account. In other words, the mere presence of funds in a joint account does not mean that the funds are owned jointly. This distinction may seem like semantics, but it can significantly impact the use of the account funds.”

According to them, when one account owner withdraws or spends joint account funds without the other owner’s knowledge or consent, they may be liable for misusing those funds.

When evaluating the management of a joint account, one must consider who owns the funds, whether the owner approved of the use of funds, and whether the funds were used in the owner’s best interest.

Hopefully, the family can answer these and other important questions by themselves without hiring any lawyers.

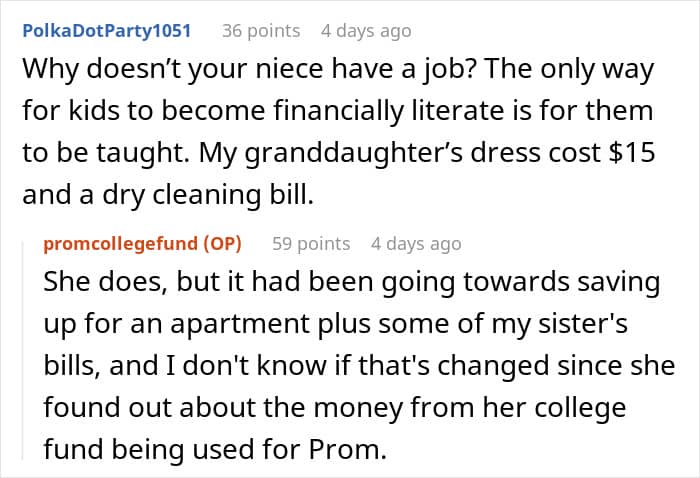

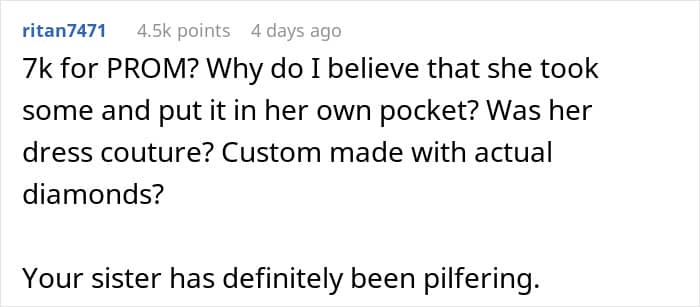

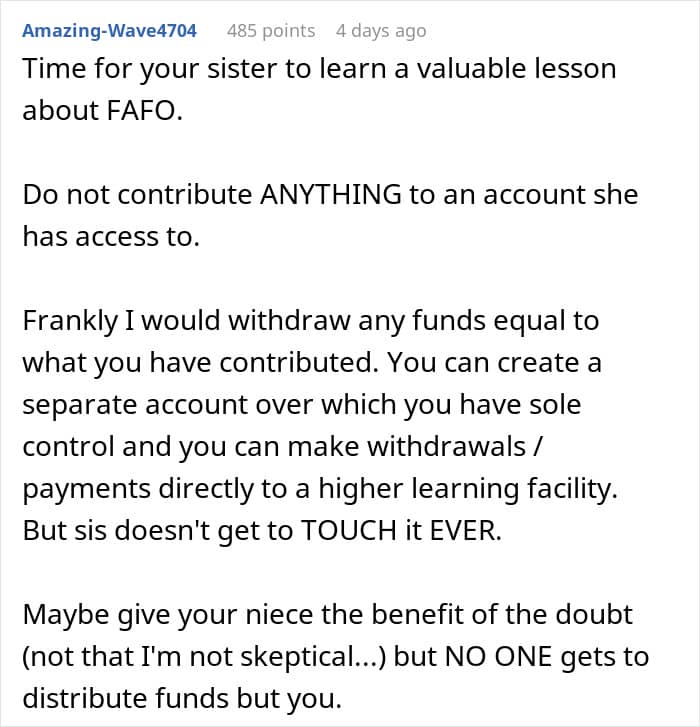

As her story went viral, the woman joined the discussion in the comments, and people couldn’t understand her sister’s actions either