When buying their first home, many couples run into a dilemma. How should they split the mortgage payments: should one partner cover it, should both pay 50/50? According to a 2016 NerdWallet survey, only 41% of couples split the down payment for a house equally.

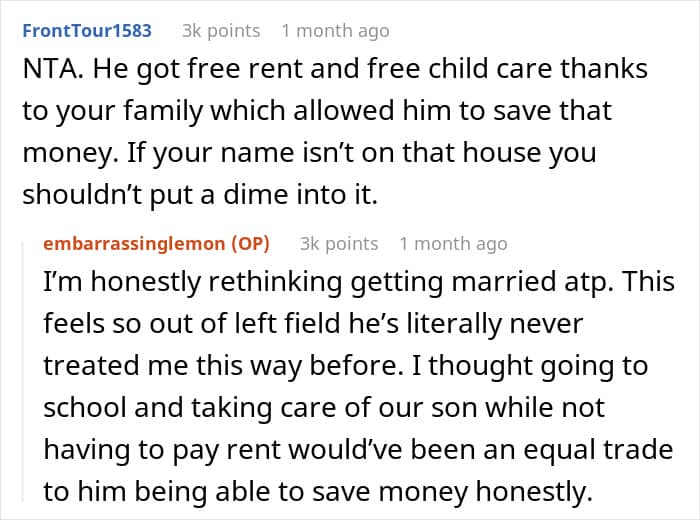

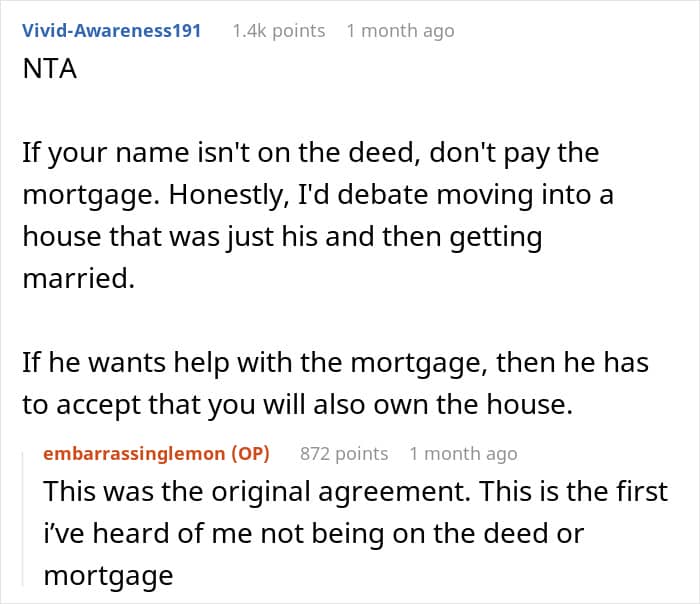

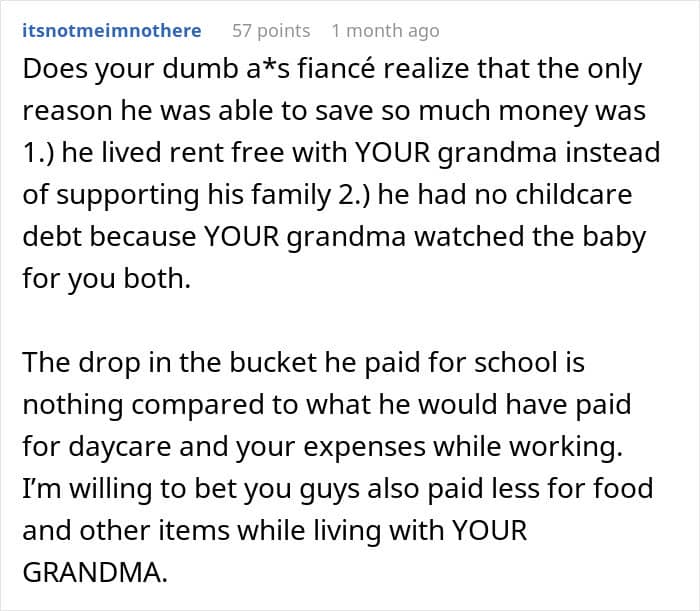

This fiancé had the same idea, but refused to let his partner’s name be on the house deed. Feeling betrayed, the mother of his child refused to pitch in at all. This argument also revealed other cracks in their relationship, resulting in an ending neither of them were probably expecting.

RELATED:A man told his fiancée he won’t put her name on a house deed even if she will be paying half the mortgage

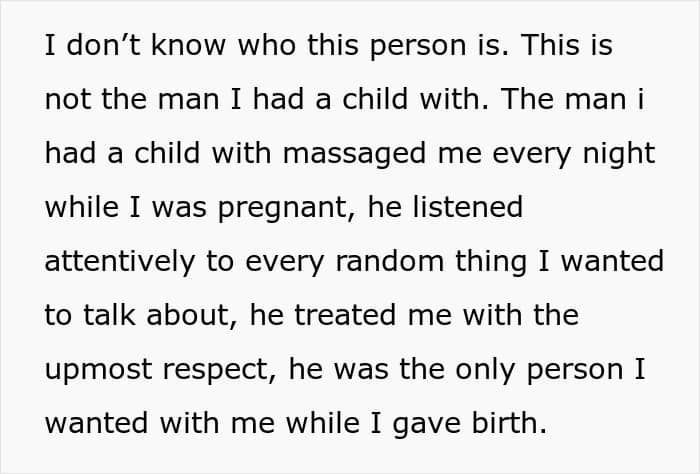

At a loss about where this is coming from, she refused to pitch in at all

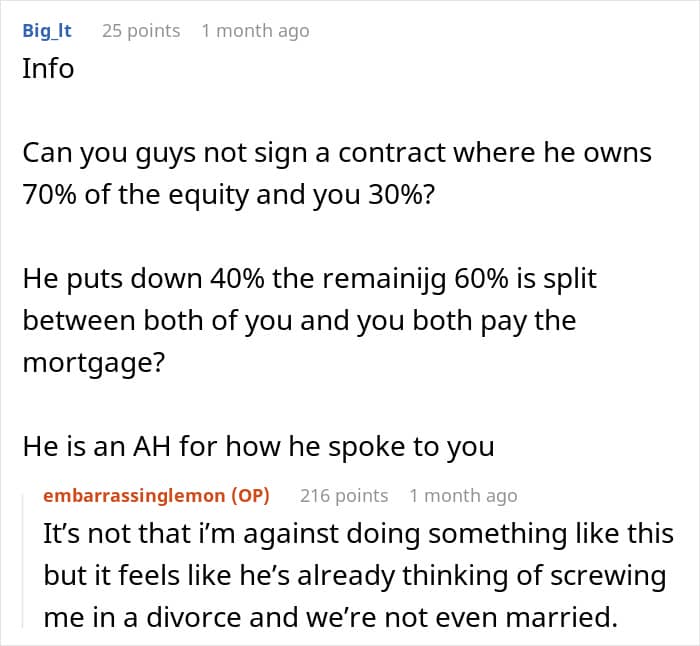

“He’s already thinking of screwing me in a divorce and we’re not even married,” the woman shared the root of her insecurities

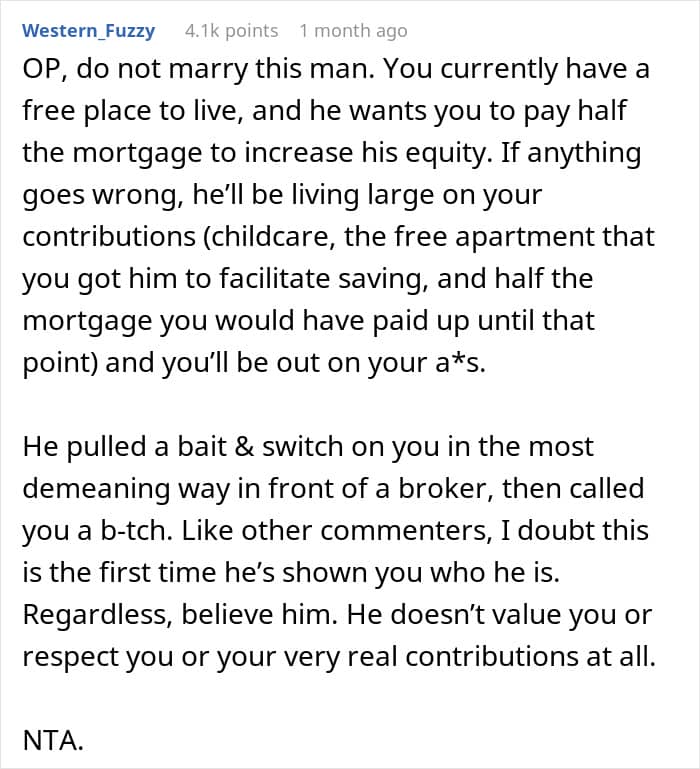

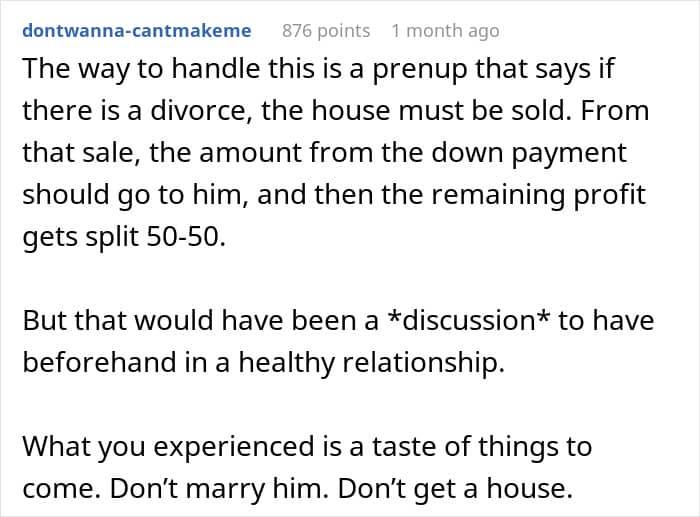

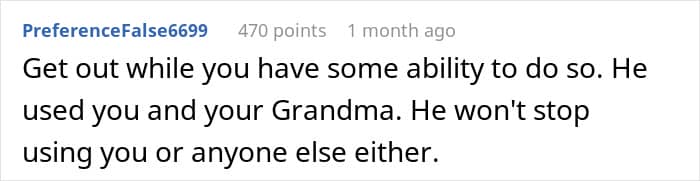

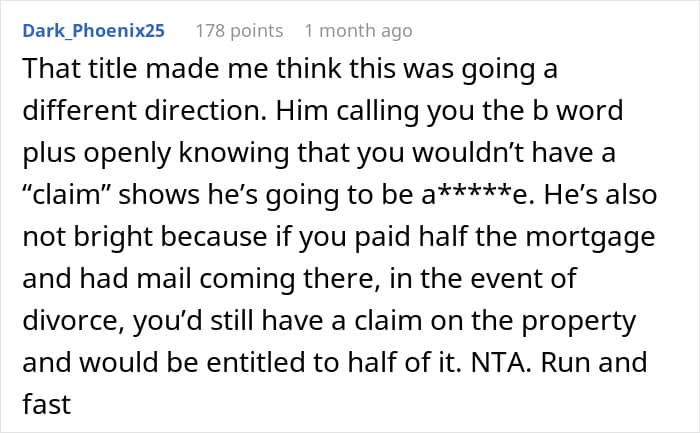

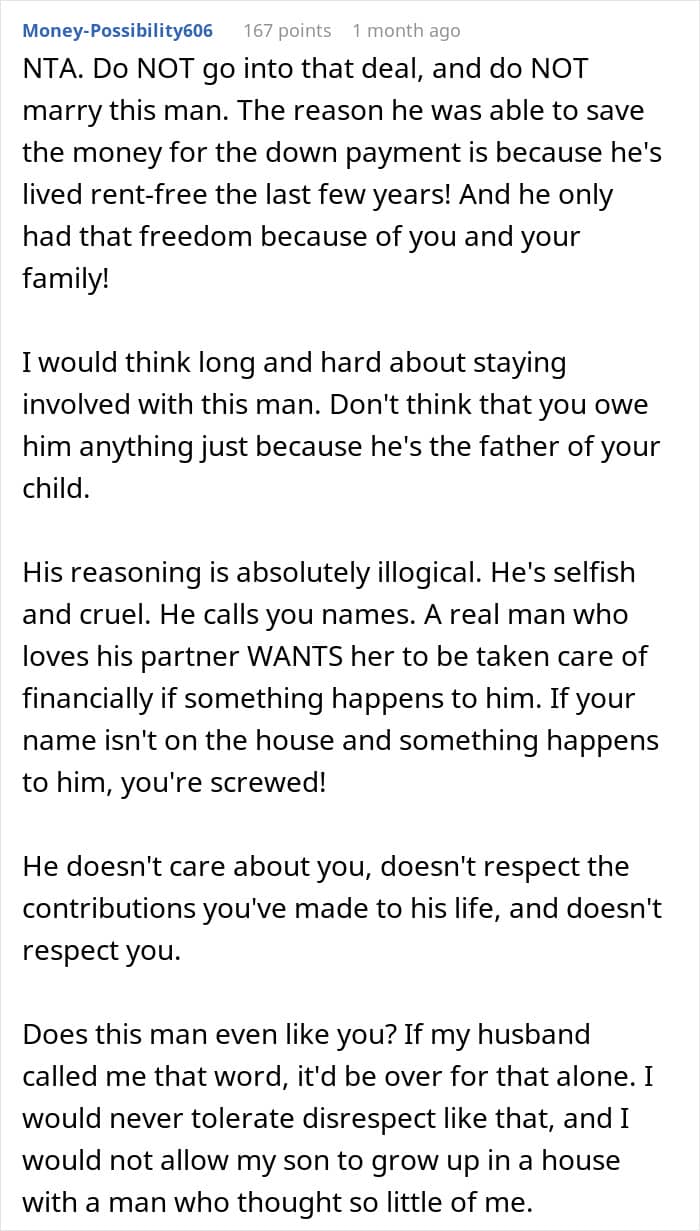

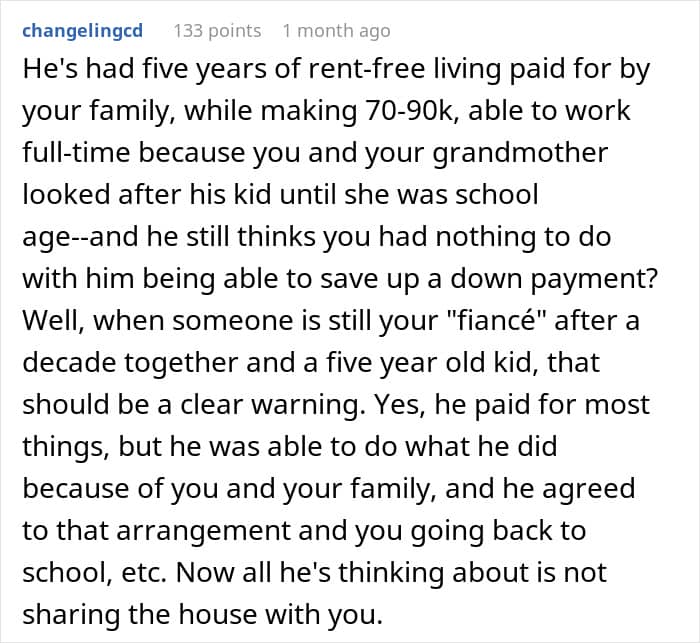

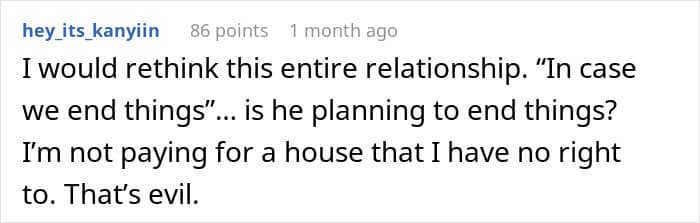

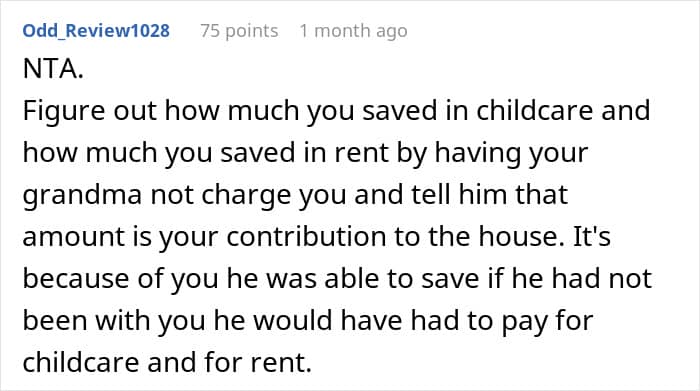

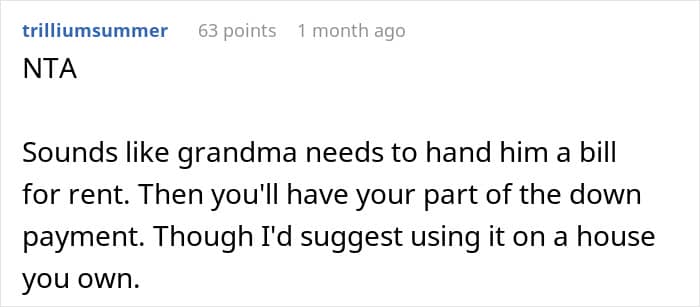

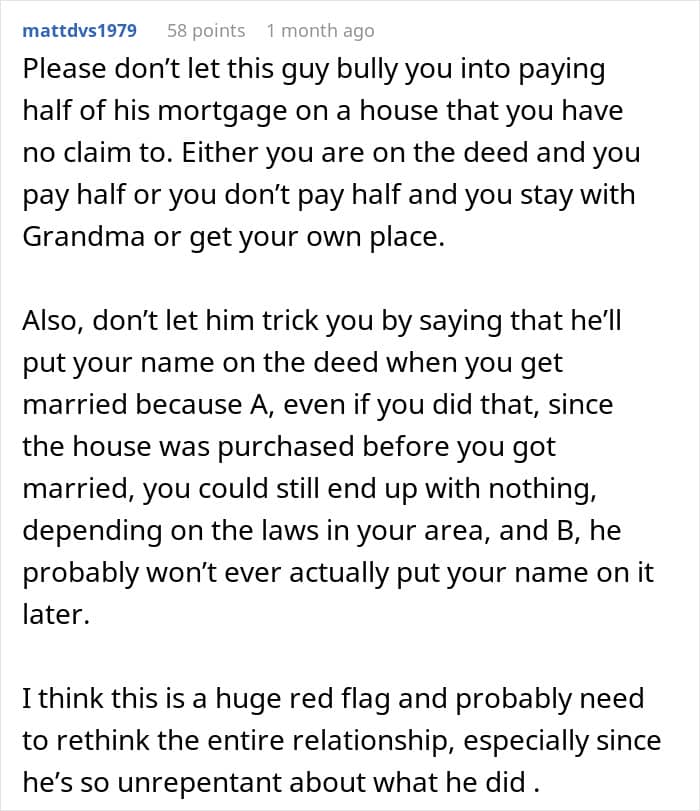

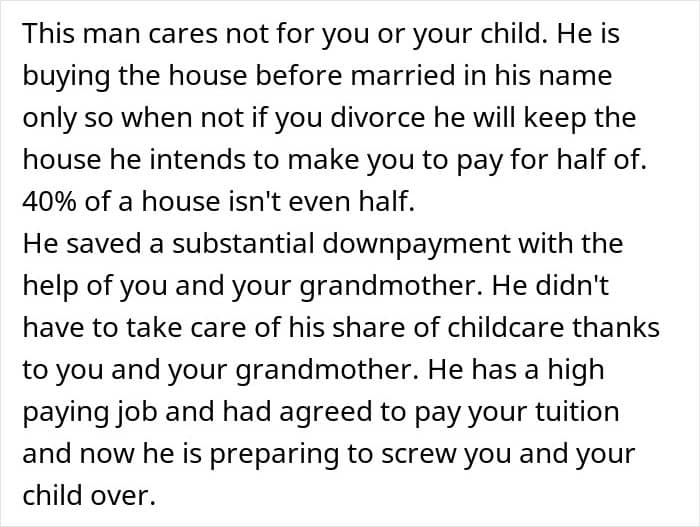

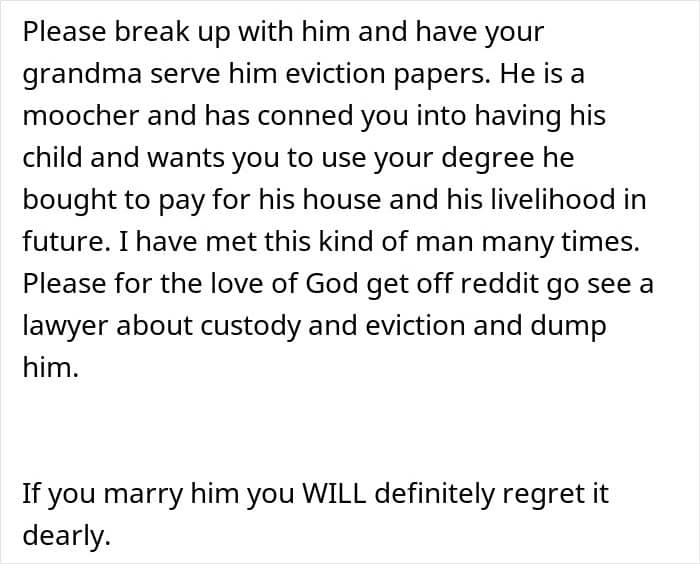

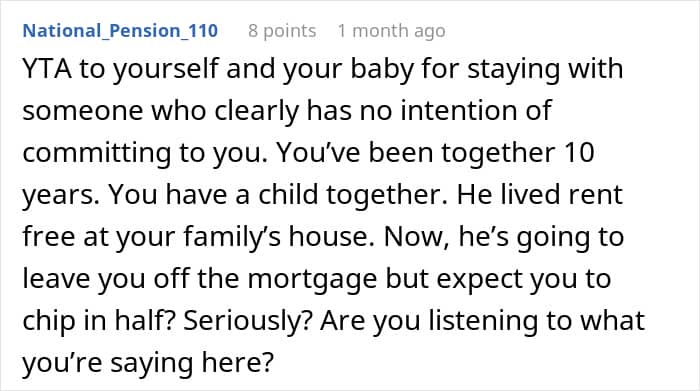

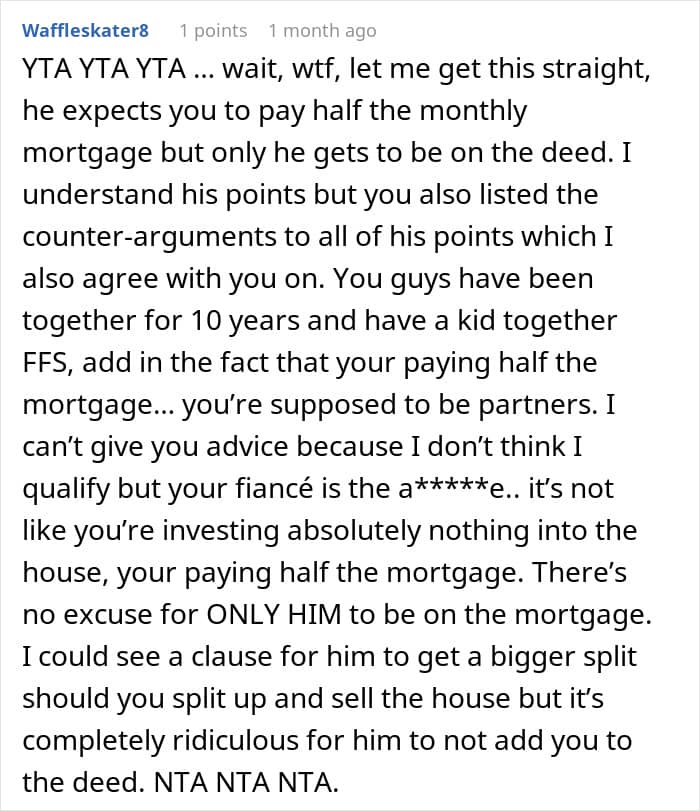

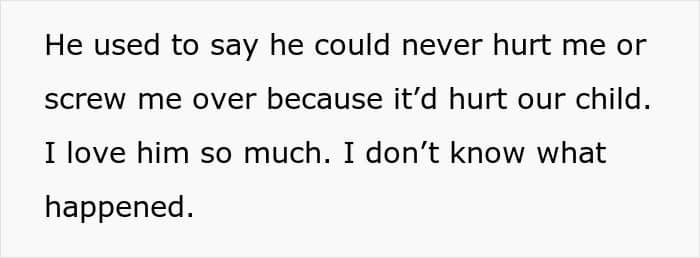

Many commenters found the fiancé’s behavior suspicious and advised to hold off on the marriage

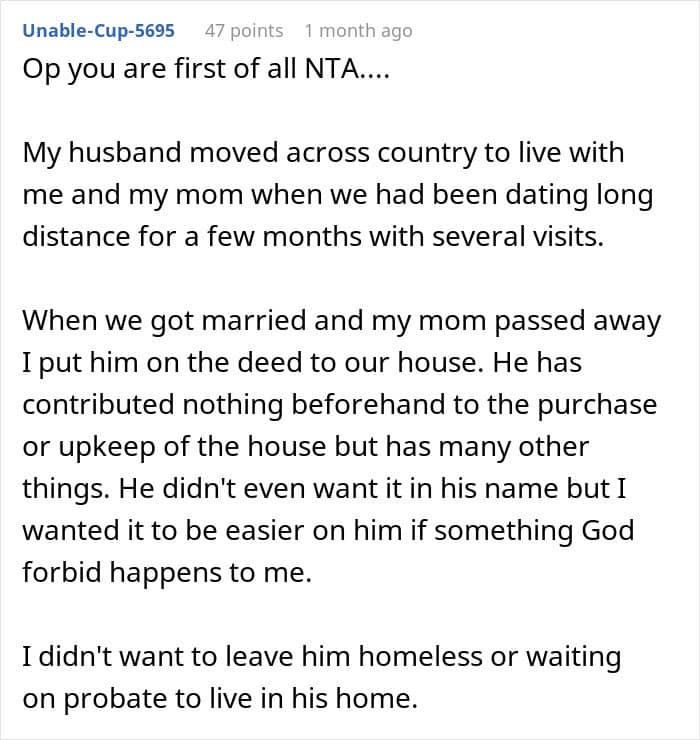

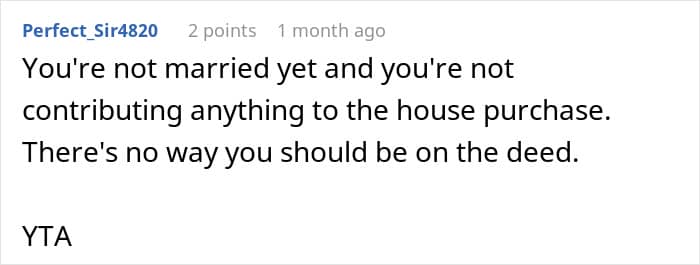

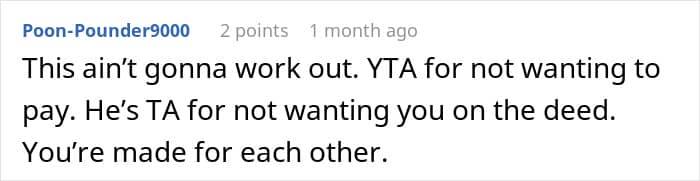

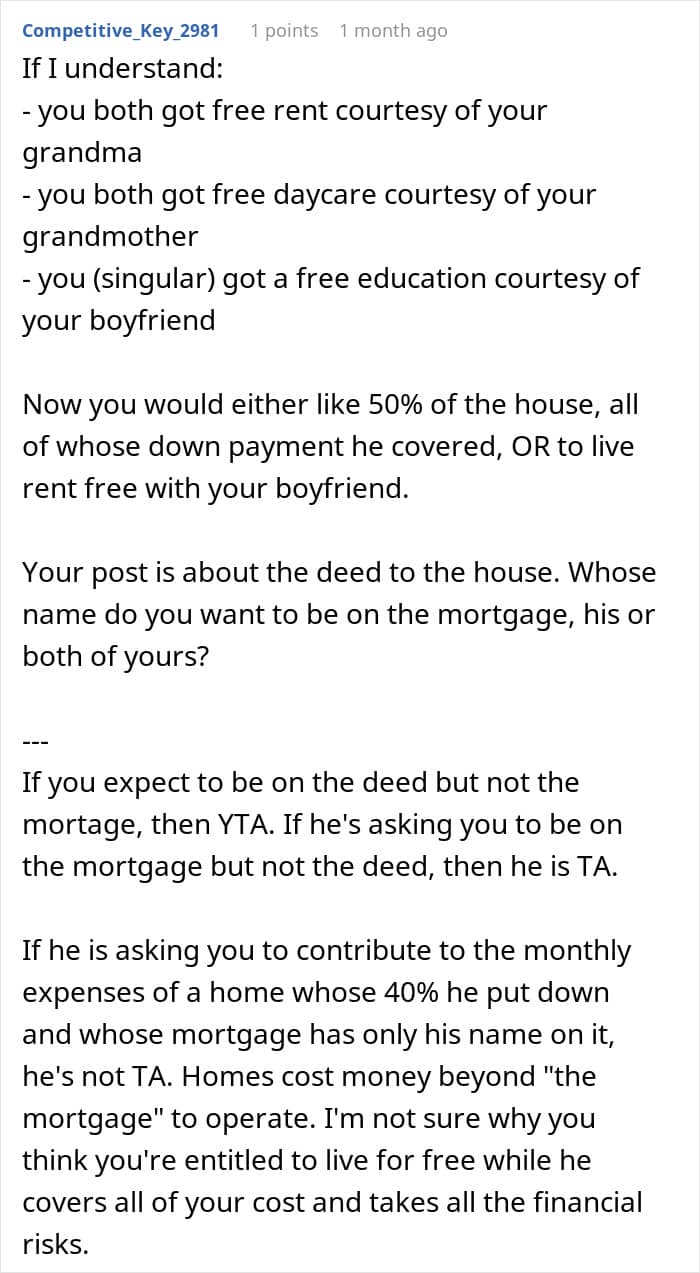

Others sided with the fiancé: “There’s no way you should be on the deed”

Many couples break up because they disagree about buying a house

“It’s only a house,” you might say. But disagreements about homeownership actually lead some couples to the brink of breaking up. In the UK, for example, six in 10 young Britons admit they’ve split up with a partner while looking for a home.

23% of the respondents claimed their partner “became obsessed with money and how much they would own,” which would eventually end in a breakup.

In many cases (68%), one partner expected the other to pay more but wanted equal ownership – much like in this story. Incorrect assumptions about who was paying what plague many couples, as a whopping 87% say they fought about how much each would put into a deposit. 89% also had conflicting assumptions about how much of the mortgage each would pay.

Relationship experts say that disagreeing about buying a house might signal more serious issues in a relationship. “Two of the many ‘big’ topics are finances and children,” life coach Jacqueline Hurst told Zoopla.

“The truth is, if you’re not comfortable having these sorts of conversations, it may not be the right time to buy a home together.”

Image credits: Ambreen (not the actual image)

Experts advise that partners share expenses proportionally

A lot of couples face a similar dilemma: should they split all expenses 50/50? Is one partner carrying more of the household’s financial burden (like it is in this case) not fair?

The experts at Ellevest, an investment platform and literacy program for women, point out that “equal” doesn’t always mean “fair”. Women are sometimes disadvantaged by the wage gap or having to take on the role of the caregiver in the family. So, they might not always be earning the same amount as their partner.

That’s why proportional splitting is the best choice for many households. First, both partners should calculate their percentage of the yearly household income. Then, multiply both percentages by the total shared monthly expenses. That’s how much each partner contributes to the household finances each month.

Image credits: EyeEm (not the actual image)

There are ways partners can protect their share of a house without a prenup or breaking up

This woman also offered her fiancé some alternatives to equal payments for the mortgage. Like commenters suggested, she brought up a prenup. Although he rejected it, there are other ways couples might find the reassurance they need.

For unmarried couples, most experts advise drafting a cohabitation agreement. In the document, the couple may specify the ownership percentages and avoid conflicts if the relationship goes south in the future.

“If the home is in one partner’s name, the other may have no claim to it – regardless of financial contributions,” financial adviser Melissa Murphy Pavone explains.

Partners can also sign another kind of agreement between co-owners. In the UK, it is called the deed of trust. It’s a great choice for couples whose financial contributions to a property are unequal.

“This allows those who jointly purchased a home to protect their share of the investment – money they can then use to get back on their feet,” consumer expert at the property website Zoopla Daniel Copley told The Guardian.

Image credits: freepik (not the actual image)

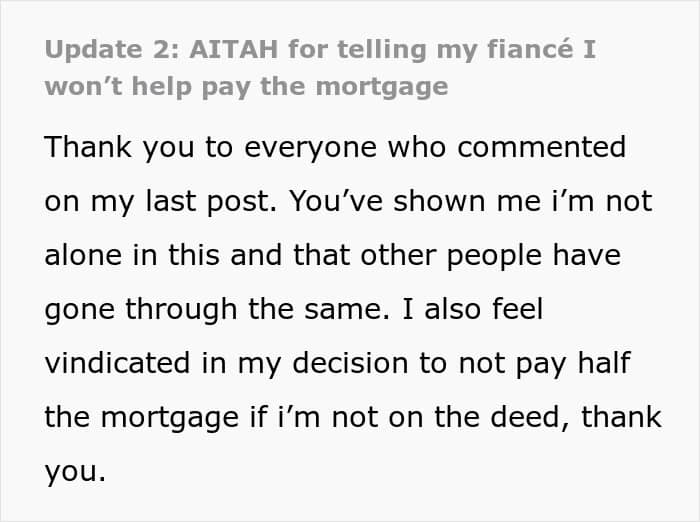

A few days later, the couple had a heated confrontation

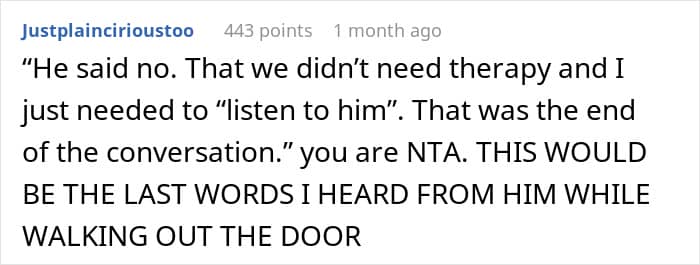

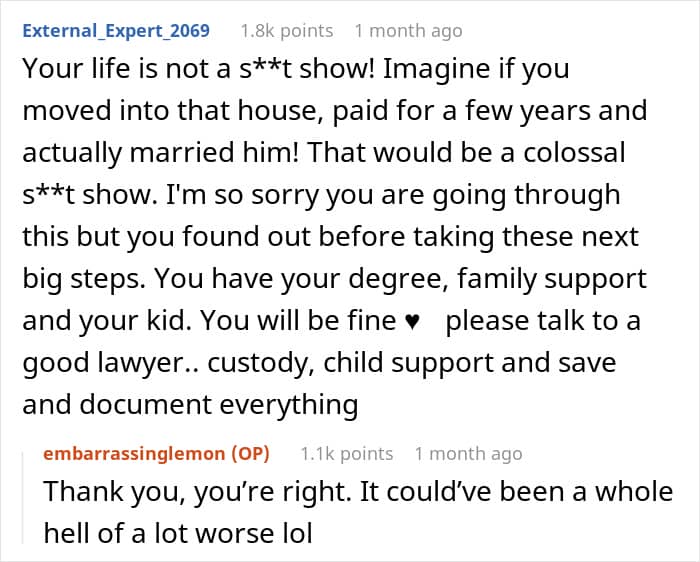

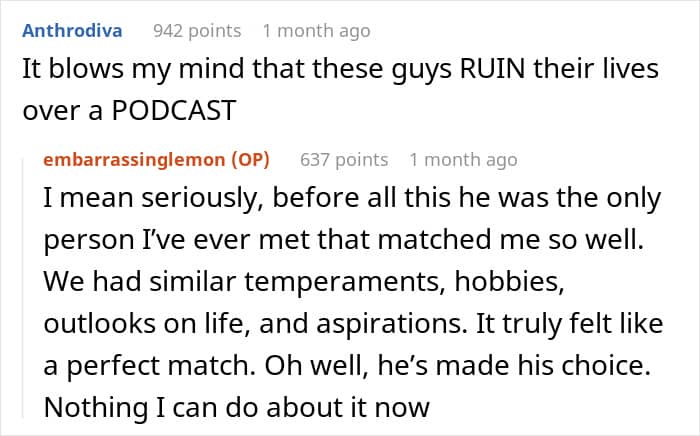

Commenters urged the woman to leave her fiancé ASAP

The couple’s next conversation didn’t end so well

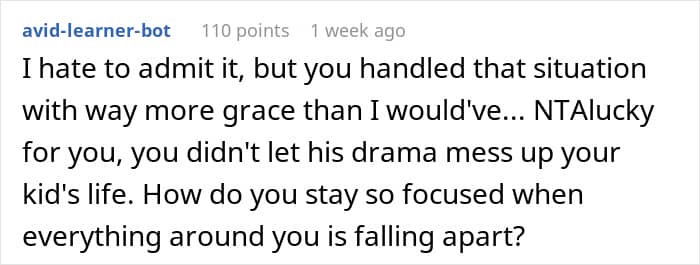

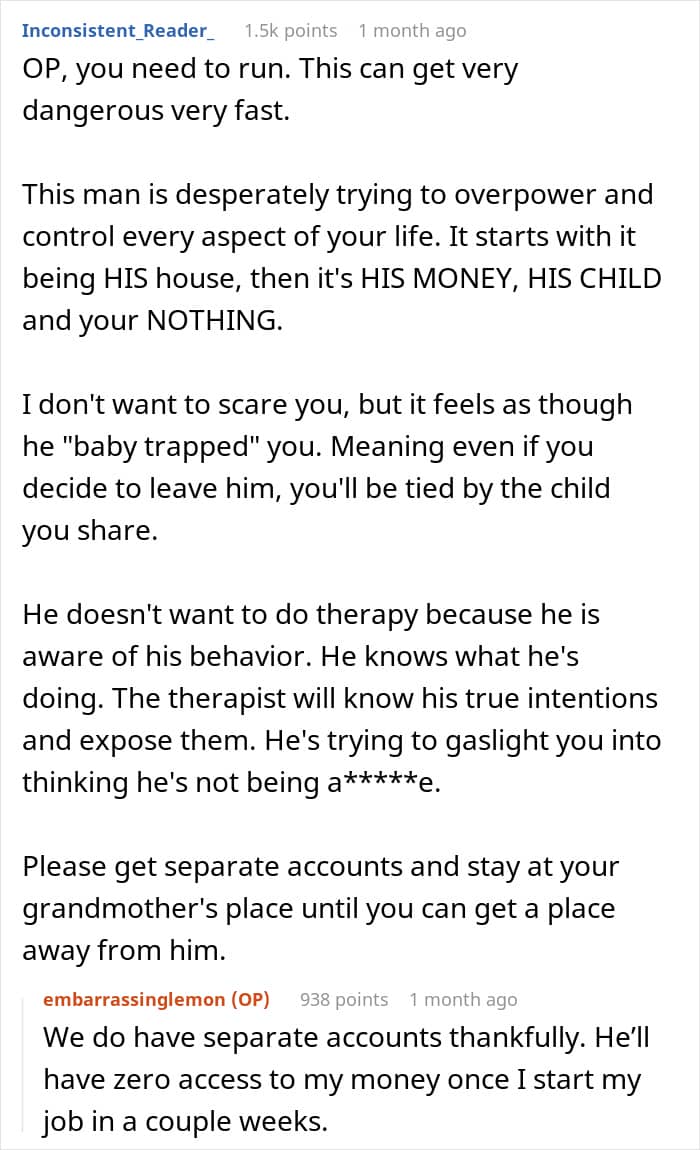

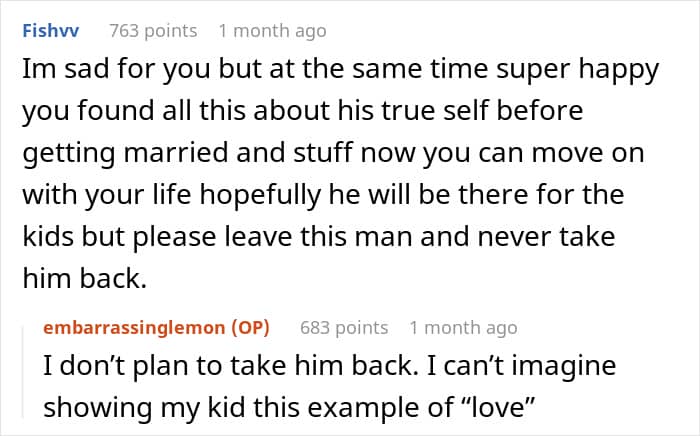

Commenters cheered for the protective grandma and congratulated the woman for finally seeing who the man really is

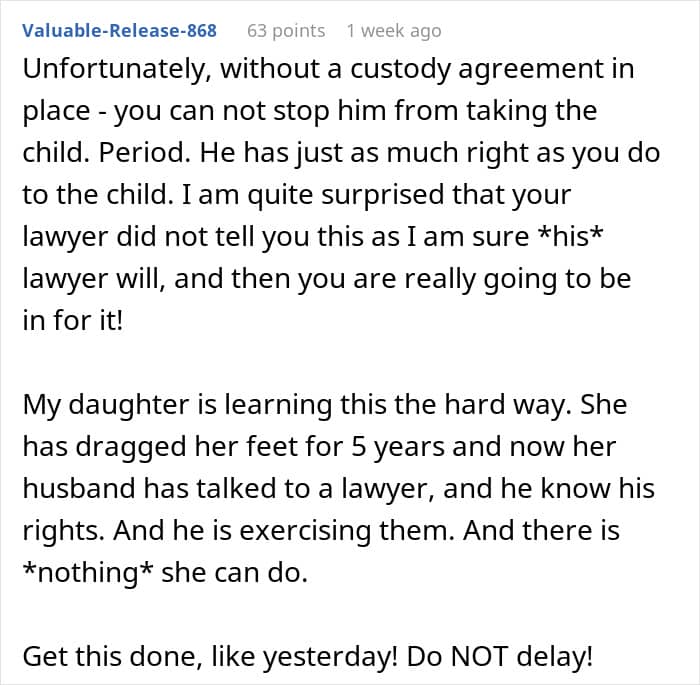

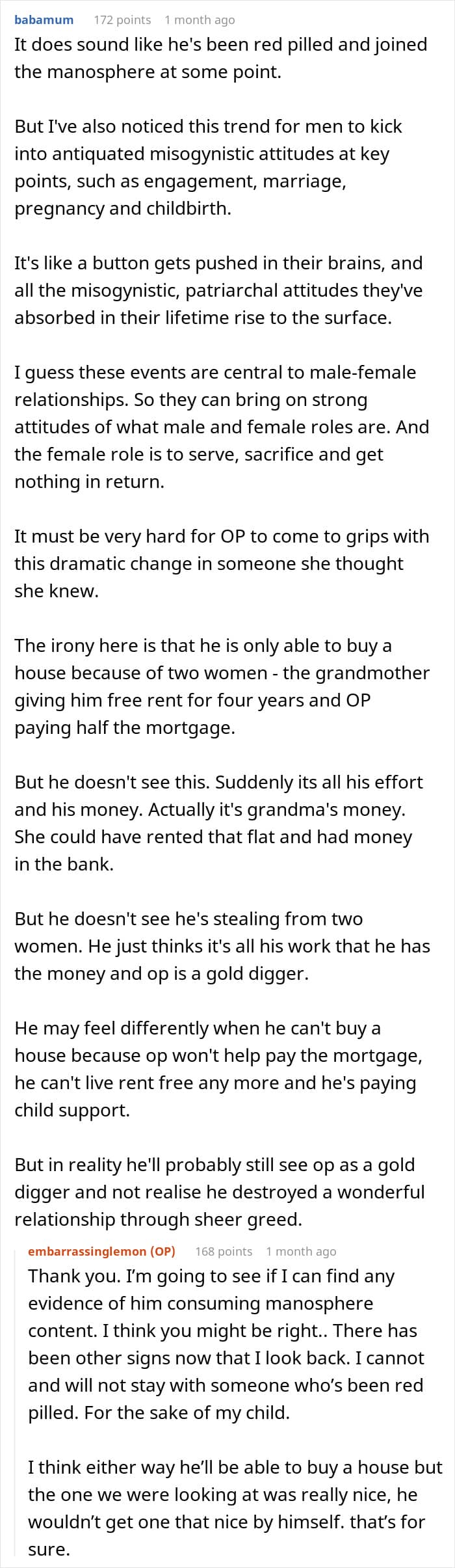

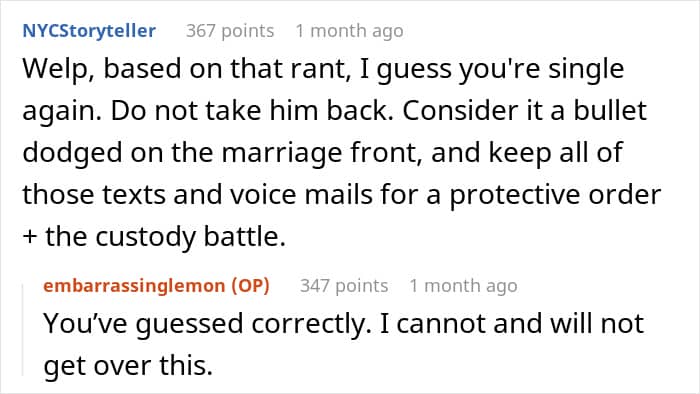

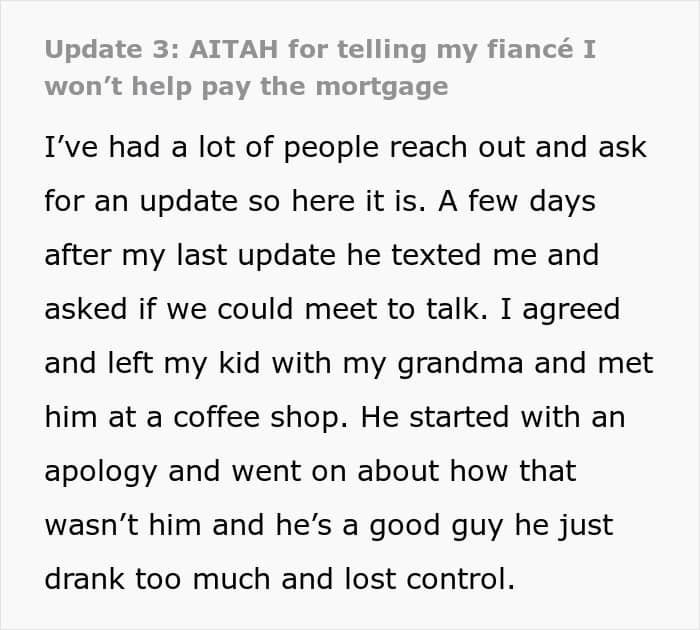

The couple’s last conversation ended in a lot of uncertainty about their future as co-parents

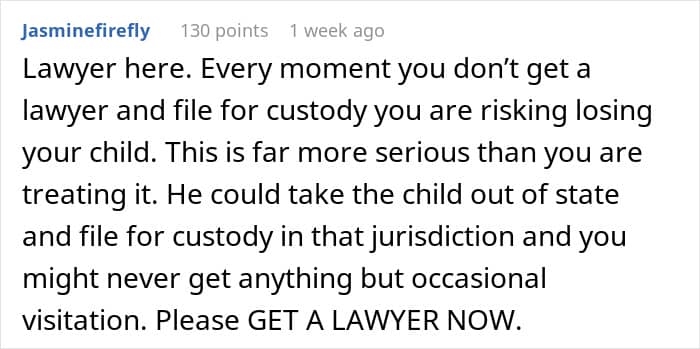

People urged the woman to lawyer up if she doesn’t want to lose her kid